Rockley Photonics is set to merge with SC Health, a publicly traded special purpose acquisition company (SPAC). The transaction will result in Rockley listing on the New York Stock Exchange and values the company at value of $1.2 billion.

The merger will accelerate the commercial launch of Rockley’s ‘clinic-on-the-wrist’ sensing technology that enables continuous non-invasive monitoring of biomarkers like glucose, hydration, blood pressure, and more.

The transaction is expected to deliver up to $323 million of gross proceeds to the combined company, including the contribution of up to $173 million of cash held in SC Health’s trust account. The combination is further supported by a $150 million PIPE at $10.00 per share

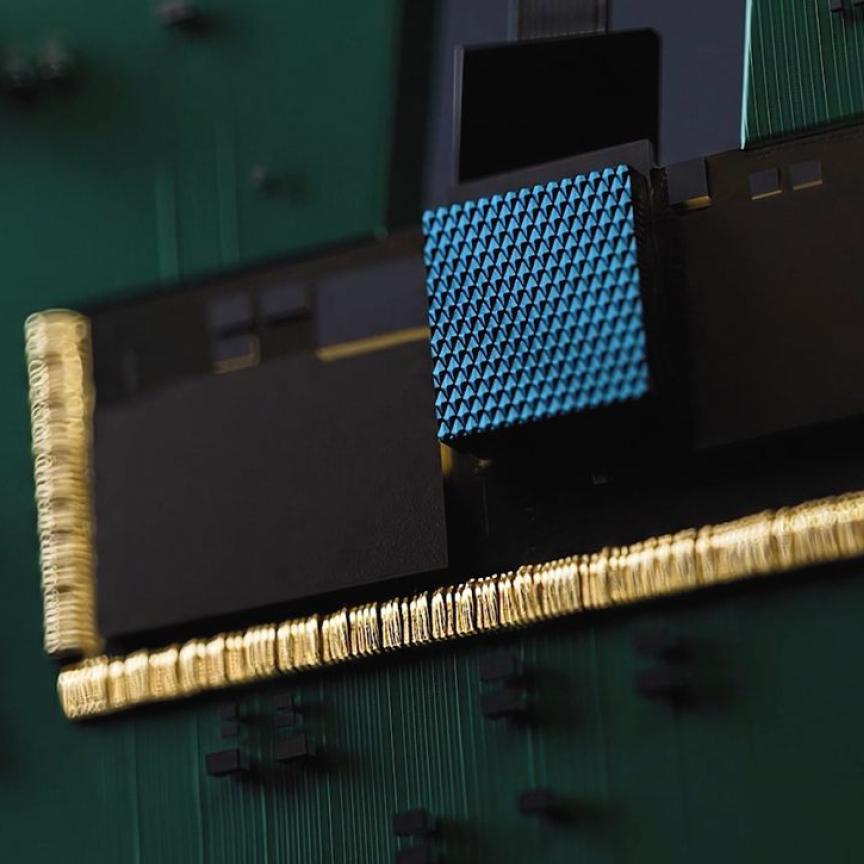

Built on its silicon photonics platform, Rockley’s ‘clinic-on-the-wrist’ technology is more accurate than LED sensors commonly used today in wearables, according to Rockley, and allows for continuous monitoring of key vitals in a way that was previously possible only with clinical machines.

Rockley is working with large consumer electronics and wearables companies to provide them with a full-stack solution, including co-packaged hardware devices, biosensing algorithms, firmware, and data analytics to enable these customers to provide meaningful and actionable insights to their users.

Dr Andrew Rickman, Rockley’s founder and CEO, commented: ‘Our partnership with SC Health positions us to accelerate our time-to-market for our compelling health and wellness solutions,’ he said. ‘We believe that bringing laboratory diagnostics to the wrist will transform patient monitoring, healthcare delivery, and overall consumer health and wellbeing.’

Beyond consumer electronics, Rockley is partnering with clinicians and MedTech companies to expand the application of its monitoring platform to medical devices to improve disease detection and prevention.

Rockley’s platform supports cost-effective, high-volume manufacturing. Its manufacturing ecosystem, with capacity reserved, and proprietary process flows will enable rapid scale-up for volume production of its highly integrated optical/electronic devices.

Rockley has also applied its integrated photonics technology to deliver chipsets for high-speed data communications and machine vision applications, including lidar.

Its technology is protected by over 120 patents and the company has raised $390 million in funding from over seven years of product development.

Transaction Overview

The transaction involved participation from investors including Senvest Management LLC and UBS O’Connor and participation from Medtronic. Proceeds of the transaction will support the company’s continued growth through ongoing product development in close collaboration with its initial customers.

Existing Rockley shareholders will roll 100 per cent of their equity into the combined company, demonstrating their conviction of Rockley’s continued growth trajectory.

The transaction is expected to close in the second quarter of 2021.